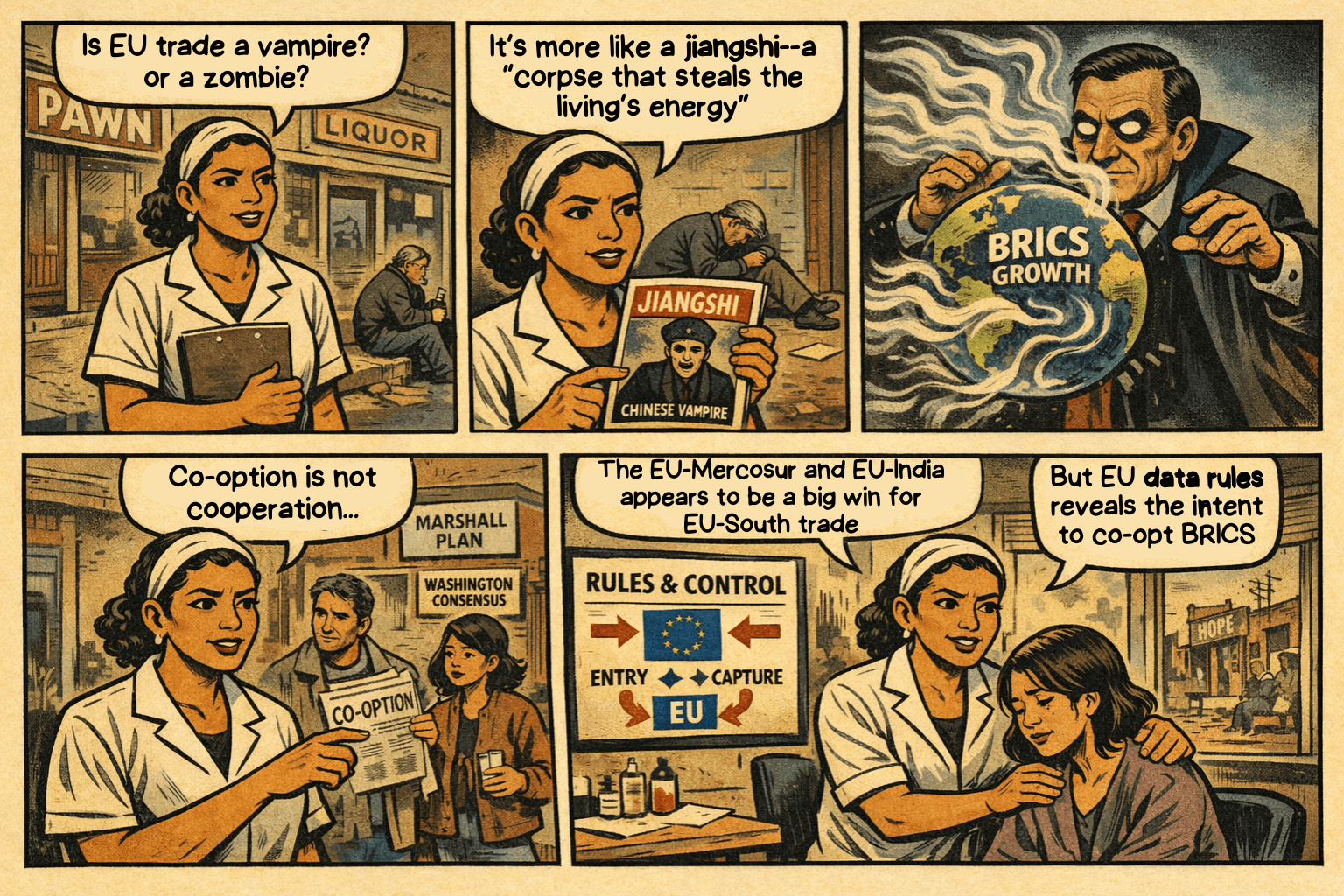

Not Vampire, not Zombie, but Jiangshi

In the multipolar daylight, Europe is neither vampire nor zombie. The better image is the jiangshi. In Chinese folklore, the jiangshi is an old corpse that cannot generate life from within and survives by consuming the qi, the life-force of the living. That is an appropriate depiction of a fictional EU-BRICS arrangement. The issue is not whether the EU will join BRICS, it will not and to be clear it has not stated that. The issue is whether the EU can enter BRICS-adjacent growth zones and redirect that life force through European legal and regulatory systems. That is why co-option is the right term. Cooperation implies a shared design, like the Marshall Plan or the Washington Consensus. Co-option means entry, capture, and rerouting.

BRICS, as members of the G20, sits at a key intersection between OECD-linked capital and G77 development priorities. While that overlap is shifting the economic compass toward multipolar centers across Africa, Asia, and Latin America, the Global North still has advantages vis the US military expansion, as well as the EU rule making authority in Brussels. In that setting, the EU does not need formal BRICS membership to weaken BRICS autonomy. It can work through bilateral agreements, standards regimes, conformity requirements, compliance audits, and market-access conditions that can capture economic and financial growth through legal back door compliance programs.

Subscribe to Decolonize Accounting. This is a reader-supported publication. Paid subscribers will receive access to reliable and verifiable “black” papers, as well as my updated Density Debt Index

EU Environmental Harmonization

While it seems clear that Trump’s impetuous unreliability and tariff policies accelerated Europe’s move towards a more independent trade autonomy, the EU shift, with partial UK alignment, is taking advantage of its role as a major rule-exporter in digital and environmental data governance. That is why EU-India and EU-Mercosur matter beyond tariffs: they are legal channels for setting compliance in markets central to the next phase of multipolar trade.

This next phase, however, appears to be harmonizing with the 2030 timeline of the Sustainable Development Goals, and while this sounds like a positive planetary win, I would caution that from the perspective of natural capital valuation, the alignment between the SDGs, the 2025 revision of the System of National Accounts, and the inclusion of the SEEA, System of Environmental Economic Accounting, will be locking partners into external standards, verification systems, and dispute architectures controlled by Brussels. The most strategic layer is environmental data.

If SDG-era data control is now primary terrain, then much of the EU’s trade diplomacy will downstream data governance. The EU model ties access to data production, data format, traceability, and third-party verification under EU-compatible service oriented templates, likely to induce significant costs to communities, creating further barriers to access for impacted communities. EUDR traceability and geolocation requirements show this directly. INSPIRE-style interoperability shows the deeper structure: define valid environmental knowledge, then define valid market participation. In the economics of this system, cooperation is the language while jurisdiction over data is the reality.

EU-Mercosur

Chapter 18, the Trade and Sustainable Development (TSD) chapter of the EU-Mercosur agreements is framed as cooperative, but it centralizes environmental-data in EU-compatible systems: its scope links trade and investment to SDGs, entirety of Multilateral Environmental Agreements (MEAs), climate, biodiversity, forests, fisheries, and transparency, which makes environmental information a core trade object rather than a side issue (Chapter 18, scope provisions); Article 18.10 then anchors measures in recognized scientific and technical bodies and international standards, with precaution under uncertainty, which in practice advantages actors with stronger certification and interoperability infrastructures (Chapter 18, Art. 18.10); the forests, biodiversity, fisheries, and responsible supply-chain sections deepen traceability and verification expectations so market access increasingly depends on EU-legible proof of origin, legality, and sustainability (Chapter 18, thematic sections); and as stipulated in (18.15), is subject to the same dispute settlement mechanisms (21.3).

The result is the further and ongoing exclusion of indigenous, peasant, conflict displaced and climate vulnerable at-risk communities in regions already impacted by climate change and social instability. Unlike the harsh colonial methods of the 19th century or the neocolonial post war resource grabs, this is a 21st century soft-hard governance system where cooperation is the language, but one where there is a US$100 trillion+ data-validity jurisdiction that remains external to partners. Although I discuss this elsewhere, the Natural Capital valuation is one that will primarily benefit the OECD countries with the highest debt, managed by the biggest asset managers. This is neither fair nor equitable.

EU-India

The EU-India Trade and Sustainable Development chapter (Chapter 21) is comparable to EU-Mercosur on the environmental-data front, even if the chapter numbering differs. Unlike the Mercosur text, I have only seen the India draft and the technical certification aspects seem like a work in progress, without the formal institutionalized governance of Mercosur. However, the India text does combine market access with sustainability obligations that require measurable, verifiable compliance. The practical hegemony channel is external to tariff tables: exporters must increasingly produce EU-legible evidence on emissions, traceability, and due diligence to preserve access. That pressure is reinforced by EU-side regulations such as the Carbon Border Adjustment Mechanism (CBAM) and the EU’s Regulation of Deforestation-free Products (EUDR), which sit outside the FTA text but materially condition participation in the EU market. So while these market mandates may seem benign and even worthwhile, structurally, they are housed within the same structural discourse as sanctionable and hegemonic.

Both these agreements function as legal corridors where “cooperation” language coexists with EU-centered data validity, verification standards, and compliance sequencing. This all goes to show how intermediaries like auditing, validation, banking, insurance, all the regulatory administrations go towards creating value over environmental data will do little more than perpetuate the rentier economy, when alternatives benefitting planet and people could easily exist.

This is why I argue that environmental data hegemony may matter more than tariff schedules and to call the EU-India agreement the “mother of all trade deals” is more of a PR pitch. This deal will formally captured trillions of dollars of SDG data that India will produce, rather than the mere billions of dollars from market access. In this scenario it is the EU that defines the environmental data standards whose intermediaries will decide who is legible, who is fundable, and who is excluded. That is co-option, more than a blood sucking vampire, the EU is a soul snatching jiangshi, feasting on the life-source of planetary data.

BRICS and the RCEP

From this angle, BRICS and RCEP are central, not peripheral. When one considers that BRICS also lead the G77 developing countries, the Global South is expansive reaching across environmental swaths of vast forest and ocean data that should be owned and managed by the indigenous or customary stewards of these regions. Developing countries and peoples are central to the traditional rules of trade, even if they have not been central to the National Accounting revisions or the advancement of the SEEA Central Framework. And while BRICS may be building alternatives in settlement and development finance, and the RCEP in market and production integration, these institutions have not participated in the changes being made to environmental rule making in the system of national accounts. Can BRICS or the RCEP protect indigenous policy space while avoiding capture by the EU compliance systems. Can they coordinate standards that support local data sovereignty or support the development of intermediary markets that do not treat the environment as commodities to be managed by Wall Street asset management firms like BlackRock, Vanguard, or Fidelity?

So the conclusion is direct. We are moving from a WTO-unipolar legal center to a contested multi-node order. The EU is unlikely to join BRICS, but it will continue trying to shape BRICS-adjacent trajectories through legal insertion and standards power. The US remains constrained by a debt-military nexus that relies on coercive trade tools and security pressure to try to extend their influence.

The emerging center across BRICS and RCEP, with strong China-ASEAN weight, can hold if it avoids two traps. The first is vampire economics: neoliberal privatization that extracts public capacity. The second is zombie stabilization: permanent emergency financed by debt and militarization. If multipolar institutions reproduce either trap, the old crisis returns like a spirit snatching jiangshi.

Future casting

If BRICS can support initiatives taking place within the G77 when it comes to local data sovereignty, and the establishment of alternative valuation schemes that can benefit trans local intermediary markets within BRICS new payment, finance, and trade systems that will protect social reproduction and sovereign development space, then the transition can endure. The strategic task is to keep qi in living societies and out of exhausted empires, even when co-option arrives politely, over tea and weiqi.

Key references

System of National Accounts (2025)

SDG Report (2025)

SEEA Central Framework (2012) SEEA

SEEA Natural Capital Accounting For Integrated Biodiversity Policies (2020)

World Bank Changing Wealth of Nations (2018)

European Commission EU-India Agreements (2025)

European Commission EU-Mercosur Agreements (2026)

European Commission-INSPIRE Knowledge Base

European Commission-Regulation of Deforestation-free Products

European Commission-Carbon Border Adjustment Mechanism

BRICS https://infobrics.org/

RCEP Regional Comprehensive Economic Partnership

https://onibaba.substack.com/p/jiangshi-trade-how-the-eu-co-opts