Workshops on Environment, Sustainable Development and Religious Engagement, Co-Sponsored by G20 Interfaith Forum, Brazilian Center for Studies in Law and Religion, Federal University of Uberlandia. Manaus Brazil June 17-21, 2024

The Relevance of Indigenous Knowledge and Rights of Nature for Responding to Climate Change

Workshops on Environment, Sustainable Development and Religious Engagement June 18, 2024. G20 Interfaith Forum

I’d like to welcome you all this morning with a deep breath and a stretch and thank the IF20 organizers for inviting me to participate and to introduce myself and the work that I am doing with the Pacific Theological College on resilience and ecological accounting.

Last week, the Pacific Festival, the largest celebration of indigenous Pacific Islanders, took place for the first time in Hawaii. In a side event, the Protecting Oceania conference took place, addressing issues around militarization, indigeneity, and struggles against extractive industries, resource depletion and neoliberal privatization. It was organized by friends and colleagues, including PTC, Pacific Theological College.

I was planning on addressing the Pasifika issues here, but I suspect that in the context of the Amazon, you will already know them. Even though I am in a different place with a different name, I think it is the same struggle against the same face.

I am the director of Intemerate Earth, a non-profit that is addressing national accounting issues from the perspective of ecological economic accounting and local data sovereignty.

People ask what is Intemerate? What is intemerate accounting? I’ll talk about this more later, but the word intemerate means sacred or sacrosanct, and I chose that world because of its association to describe immaculate conception and the miracle of the virgin birth. Intemerate is something you cannot put a monetary price on, and this is how we should value nature and our ecological biodiversity, treating it as sacrosanct.

I am also a curriculum writer and teaching at the Pasifika Communities University in Fiji. This course is part of an accredited degree program in the School of Sustainability and Resilience Development, and it intersects community consultation with indigenous and customary Pasifika epistemologies deeply rooted in decolonization and self-determination. This program was developed to prepare graduates with a professional degree that will help transition Pasifika economies towards Resilience and Sustainability.

I’ve been asked to talk about the Rights of Nature, Ecological Accounting, and its Relevance to Indigenous Knowledge.

In yesterday’s “paths to prosperity” panel was excellent in that there was a recognition of the need of data and its relationship to the bio economy. Patricia Gomes said it was impossible to have investment without data, but my presentation demands that we recognized who the stewards of this data should be. So, to some this presentation might be very disruptive. And if it is, I hope this presentation expresses why it should be.

National accounting systems influence global economics, yet activism against these systems has been minimal. The UN Statistical Division’s lack of Global South representation must change.

Historically, national accounting evolved to justify the expansion of Empires; it was national accounting that justified the oppression of women, slavery, and genocide. National accounts were used in trade statistics, currency valuation, war statistics, weapons development, and it should be common knowledge by now that those who control national accounting systems control the global economic system.

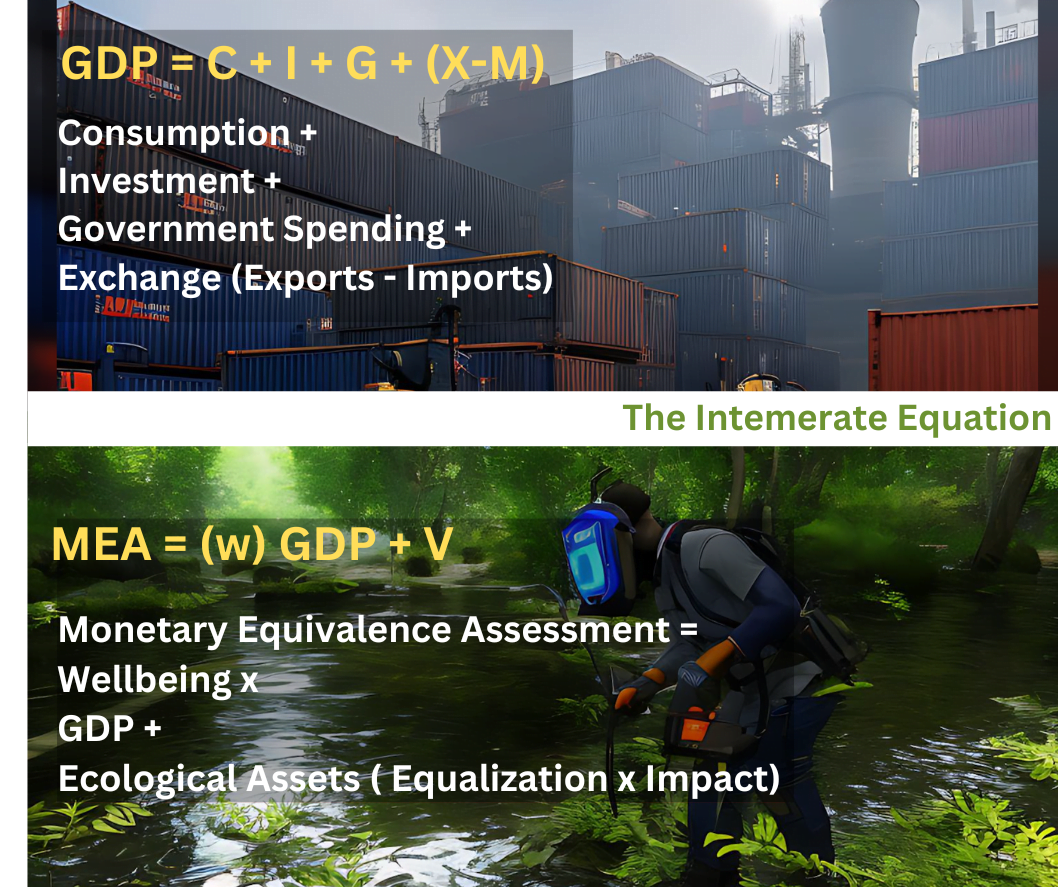

What I propose is that by integrating well-being, environmental sustainability, and social equity into national accounts, we can transform both ecological and economic systems. How we account for our ecology is as much about ecological justice as it is about economic justice.

This realization was a revelation. It underscored the profound influence of national accounting systems on global power dynamics and social injustices.

Yet, despite the critical importance of these systems, there was not a lot of activist campaigning directed at the UN System of National Accounts where this system is harmonized.

PTC and the senior advisor at Pacific Island Forum Secretariat both responded to this accounting disconnect and we began developing this program. At that time, the ecological accounting program was central to the development of the Blue Pacific Framework. However, shifts towards neoliberal data accumulation have since emerged.

PTC and the Pacific Conference of Churches that really embraced this work and included it in the Reweaving the Ecological Mat program, and it was through a series of intensive discussions with regional and community leaders that this work was supported.

They published my book Ecological Economic Accounts: Towards Intemerate Values, which I plan to rewrite to include the village consultations and the curriculum.

In one of the remote village consultations we discussed the value of ancestral bones. It was inconceivable that anyone would try to put a value on their bones or try to own them or manage them. Bones are sacred, they have an intemerate value. Recognizing that there is a deep cumulative knowledge—a past, present, and future—going back to their own creation stories with genealogies that are so rich in data that protecting this data had to become the primary focus.

Losing Indigenous data to data transparency initiatives being written into legally binding trade agreements could lead to over a hundred trillion-dollar theft if we consider that is what the World Bank has valued Natural Capital at.

When I say a hundred trillion, I must let that sink in. If one trillion is a thousand billion then a trillion is also a million million. S0 if we consider Natural Capital as being valued at a hundred trillion that is I think a hundred thousand billion, and after that I lose count. And while this number is so big and incomprehensive what happens when we apply this number to debt?

The United States has a 36 trillion dollar public debt, the combined OECD economies have a 64 trillion dollar debt. The rest of the G77 have a combined debt of maybe 45 trillion dollars and the Africa, Caribbean, Pacific region with the lowest development index have a combined debt of around 4 trillion dollars. These are the kinds of trillions we are talking about and so when it comes to ecological accounting and the value of natural capital, I cannot help but wonder if Natural Capital estimates are being measured against our national debts.

It’s okay if it is, as long as we understand the valuation process, but if we do not know that data accumulation is equal to wealth accumulation, then we are prey to become victim of yet another resource theft.

When we consider that Data, especially in ecological economic accounting, should be entered and counted only once to ensure accuracy and reliability, we must understand that this principle prevents inflation or distortion of values, which is crucial for creating a true representation of ecological and economic interactions.

Double counting can occur when the same data point is recorded multiple times across different categories or sectors. For example, if carbon sequestration by forests is counted in both the forestry and carbon offset sectors, it can lead to an overestimation of carbon sequestration capabilities. So if we do not own our data, and national accounting systems adopt the Natural Capital program, we will quickly be priced out of benefiting from our ecological stewardship and our access to wealth and infrastructure and development capabilities will be no different from what they are now—except worse—because we lost the opportunity to equalize how we value our environmental data. Hence the G20 is precisely the forum to be discussing this.

When we consider the biodiversity of the Amazon, like our own Pasifika region, and the entire interconnectedness of our planet, we see a creation that is wonderfully benevolent, violently robust, and immaculately conceived. Its very existence is the true work of the divine that is measurable but resists monetary valuation. The Amazon rainforest, for instance, is a testament to nature’s ability to create and sustain life in its most diverse and complex forms. Our oceans, covering the majority of the Earth’s surface, are teeming with life and are critical to regulating our climate and supporting marine ecosystems.

How we interact with our environment, recognizing its sacredness and inherent value, is what we must speak and live by. This means advocating for policies that protect and preserve our natural world and rethinking our economic systems to prioritize sustainability and ecological health. It requires a fundamental shift in how we view our relationship with nature, from one of domination and exploitation to one of mutual aid and reciprocity.

Since 1972, the concept of the Rights of Nature has been incorporated into legislation, court rulings, and constitutional amendments in several countries. Ecuador was the first to constitutionally recognize these rights, stating that nature has the right to integral respect for its existence and maintenance of its life cycles.

I’m not an attorney but I often hear about court rulings that favor the environment but that there is a lack of enforcement that renders decisions ineffective, highlighting the need for robust mechanisms to uphold these legal victories. We also hear about binding trade agreements where states can impose sanction power to enforce the rights of corporations over the rights of people and the environment.

So while the Rights of Nature have been recognized legally in various jurisdictions, why is there a lack of enforcement to bring violators to justice? Without governmental commitment and robust enforcement frameworks, court rulings in favor of nature seems to be easily ignored, undermining the very purpose of these progressive laws.

While I want to say that the true potential of the Rights of Nature can only be realized when legal victories are supported by strong, enforceable actions, enforcement will only occur when there is economic incentive, and a pathway for economic justice. The same needs to be said about indigenous people’s hard won right for the legal recognition of Free, Prior, and Informed Consent. Until there is a strong enforcement mechanism to bring violators to justice, these rights remain aspirational.

So, how should we understand the Rights of Nature? Are there mechanisms of enforcement that can recognize these rights?

What if there is an economic accounting equation and financial index that accounted for the interactions of our survival, solidarity, and stewardship, an accounting framework that measures our human interactions? What if there is a framework that gives value to our knowledge and action, rather than on commodity prices that will create further displacement? What if we could account, manage, and steward our ecological data with our own methodologies and work with indigenous or local auditors to keep our data private, out of the hands of international investment consortiums? What if we can utilize free, prior, and informed consent to determine how we participate or not participate in trans-local data markets that encourage communities to truly practice mutual aid and assist in the use of financial instruments to assist at-risk communities?

What if there was a bank that underwrote this index and helped to provide a facility where local data sovereignty can become a system for global equity in the Global South as well as an instrument for indigenous, migrant, poor or other at-risk communities to access wealth and infrastructure? What if we could develop and use our own tools to measure, analyze and quantify our data according to our own development priorities rather than rely on expensive surveillance and monitoring technologies developed by Departments of Defense?

While Ecological Accounting opens opportunities for the economies of the Global South, it is not an automatic win, but rather a strategy to level the playing field. Recent revisions to the U.N. National Accounting System have shown that adding or revising aggregates—such as the inclusion of Military Systems, Research and Development, and the Digital Economy, along with efforts to incorporate Environmental and Sustainability Factors into economic measurements create significant economic advantages over the Global South.

To be clear, Intemerate accounting doesn’t seek to disrupt the bioeconomy. What it addresses is the need to revise how we account for our interactions with the environment, against the production, consumption, distribution and exchange of goods and services.

Yesterday, Fabiola Barros gave a wonderful example highlighting the kind of stewardship in her Agroforestry presentation, integrating short-, medium-, and long-term cycles while providing food for markets.

I made a few copies of the Intemerate Earth White paper that outlines the accounting plan in more detail. We compare what we call Environmental Default Swaps with several other data financing models, like Cost-Based Valuation, Income Approach, Market-Based Valuations, and some others, and hopefully we will soon launch a proof-of-concept program to show how this would function as claimed.

The White Paper addresses how intemerate accounting values Local Data Sovereignty, provides for trans-local and interglobal data markets, collective mutual accounting, how Environmental Default Swaps can integrate with Debt Suspension or Deferment, Mitigation projects, Food and Water security, cross border collaborations, and more.

What we did was invert the traditional approach of using a baseline as a reference point from which we measure deviations that move away from a given value. Instead, we measure towards this baseline. The baseline represents the target values or the ideal state we aim to achieve. This approach shifts our perspective when it comes to measuring values, because it creates an index where people can plot their own values according to their own needs rather than trying to harmonize variations from a pre-set standard.

From a monetary perspective, it is this baseline that can financialize our interactions with the environment rather than commodify nature within the capitalist mindset of wealth accumulation and privatization. Intemerate accounting—rather the intemerate baseline provides a tangible shift in the way we think about value.

The White Paper also addresses how Insurance issuers like the New Development Bank can underwrite programs—not through conflict models like Lloyds of London, for example—but by aligning with good, practical applications of Environmental and Social Governance and Responsibility, paving the way for a new paradigm in development.

Whether ESG investors will support local practitioners and communities to be the holders of this equity has yet to be seen, but geopolitically, if we are to take seriously our motivations to restore our ecological biodiversity and provide communities to mitigate against climate change impacts on their own terms, environmental markets need coherent and strong regulatory governance, and that is not something that can happen under an accounting framework driven by data wealth accumulation.

In conclusion, as I mentioned in my introduction, our issues are in different places and have different names and different processes, but it is the same struggle against the same face. Together, let us revise the accounting framework by building market solidarity with our own accounting protocols and methodologies. This is the nugget that we hold. It is more valuable than gold, it is intemerate.